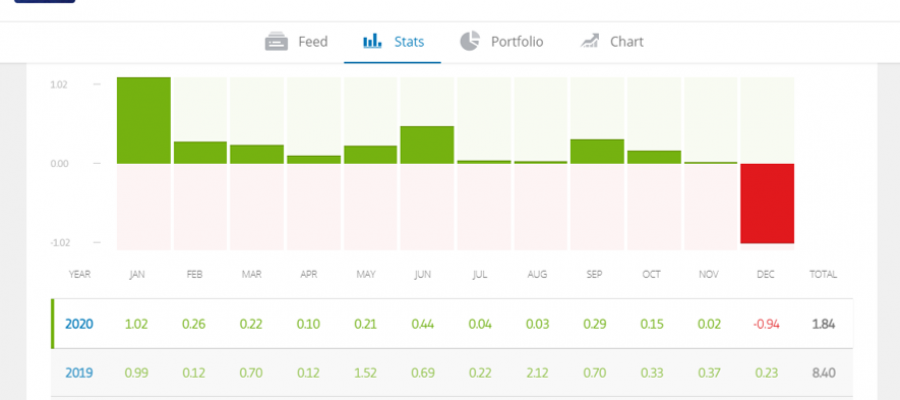

I have seen a few buzz on some social media groups expressing concern about OlivierDanvel’s performance as of the time of writing, December 19, 2020. He is currently down 0.94% (-0.94%), a rare occurrence since he hasn’t had any losing month in the 4 years that he’s trading with eToro. OlivierDanvel has become one of the go-to guy in the eToro copy trading platform if you want an ultraconservative trader in the forex market. He averages approximately 11.02% return per annum in the last 4 years but with far less return on 2019 and 2020. Still, the guy managed to be all positive in this very challenging year with Covid-19.

The question that everyone seems to be asking on some social media groups is, will this be OlivierDanvel’s first-ever negative month? With December 2020 drawing to a close and with financial markets going on holidays very soon, we are expecting a very less volatile market in the next few weeks. This means whatever open trades you have, expect very little movements on the market in the next few weeks. Looking at his current portfolio, Buying (USD/CAD) and Selling (EUR/USD, NZD/USD, GER30), it seems that he got trapped with multi-year weakening of the USD.

The question is if you are one of the copiers of OlivierDanvel, should this cause concern for you? Should you pull out your funds now? Will this be his first-ever negative month in 4 years? Will Covid-19 finally mark his unblemished green portfolio with a red stain?

See below charts for these currency pairs.

The answer is, no one knows… Not even Olivier knows. As mentioned, he is currently trading against the dollar weakness similar to thousands of traders out there (including myself). Multi-year highs with multiple indicators screaming SELL SELL SELL! But no, the USD continues to weaken. NZD/USD and EUR/USD continued to go higher and higher and USD/CAD lower and lower.

Why is this happening? Well, it’s a combination of a lot of factors. For one, according to an article on barrons.com, the USD could continue to weaken even if there is already a vaccine because the US economic recovery is not as rosy as compared with other countries. The article added, the USD could continue to weaken in 2021.

According to an August 2020 article by Fortune Magazine, USD at that time has fallen by 10%, and made gold and foreign stocks (including emerging markets) have gone up. The article mentioned: “When the dollar is up, gold, foreign developed, and emerging-market stocks tend to perform poorly. And when the dollar is down, gold, foreign developed, and emerging-market stocks tend to perform admirably.”

Of course, not to mention the fiscal stimulus which will flood the US economy with cheap money. Dollar weakness is the same message with Fitch, Yahoo Finance, JP Morgan, Goldman Sachs, and other reputable finance and banking institutions

Going back to Olivier, is it time to pull out your funds invested in him? Well, this is not an investment advice and you are responsible for your trades but here are a few considerations:

(1) Olivier currently has 9.88% of his portfolio invested in these USD dependent trades. He has 7.90% invested in GER30 which now is positive 3.13%. In the long run, there is still a possibility that he would not end negative this December 2020. He is still 82.22% liquid.

(2) This is not the first time that he had a drawdown before, but still ended the month positive. I heard Olivier in a number of interviews before. He says to let his team do the trade and analysis. It does not matter if there are losing trades (all traders in any financial markets have drawdowns and losing trades), what is important is the totality of his portfolio.

(3) If you’ve been copy-trading Olivier in the past few months or years, then you have nothing to fear for, you are still net positive to date. If you just copied him this month, well, you might be the cause of the bad luck 😁 give it a few months, I am sure Olivier has a way to recover losses.

(4) Olivier is an active trader. According to his profile, he monitors currency pairs all day. Relax, he has experience. Let him manage his trades.

Below are a few alternatives if you want to diversify.

December 30, 2020 Update – OlivierDanvel is now up +1.07%